Unraveling The Inheritance Of Jim Morrison

The phrase "Here's Who Inherited Jim Morrison's..." is an attention-grabbing headline commonly used in online articles to pique readers' curiosity and entice them into reading further. The broader topic of inheritance, and specifically who inherited Jim Morrison's estate, is a newsworthy subject.

Celebrity inheritances are often shrouded in mystery, intrigue, and public fascination. The distribution of a deceased celebrity's assets has historical precedence and cultural relevance. For example, the public was captivated by the revelation that Michael Jackson's estate was left to his children and mother, while his siblings and other relatives received nothing.

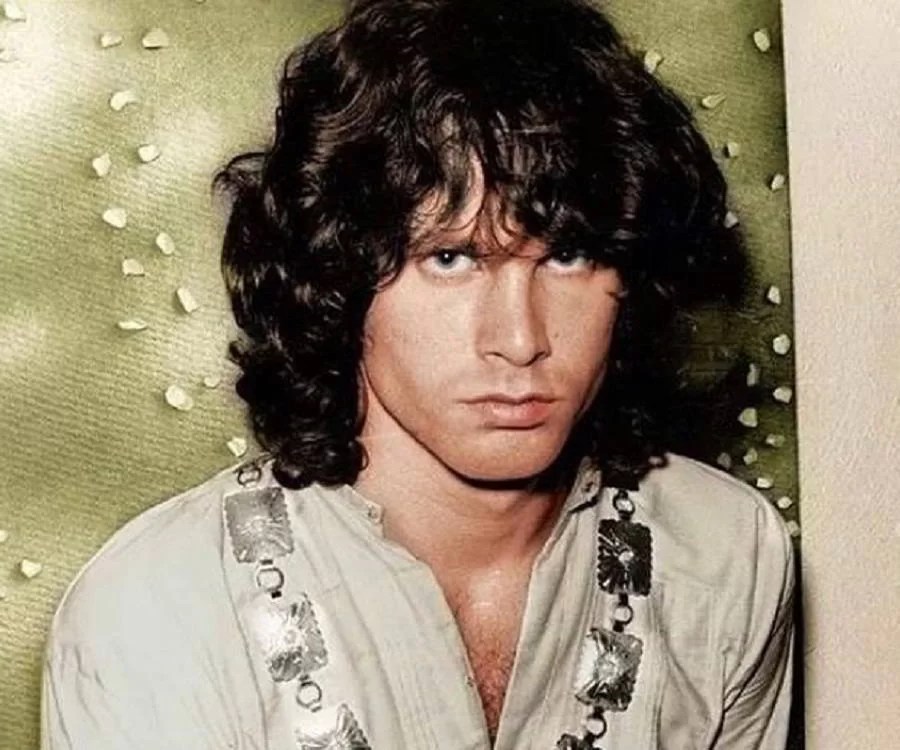

In the case of Jim Morrison, the legendary lead singer of The Doors, his death at the age of 27 left many questions about the fate of his estate. The article will delve into the details of who inherited Jim Morrison's legacy, exploring the legal battles, family disputes, and ultimate distribution of his assets.

Here's Who Inherited Jim Morrison's

The topic of who inherited Jim Morrison's estate involves several key aspects that are crucial to understanding the distribution of his assets and the legal and familial complexities surrounding it.

- Will: Morrison's will, or lack thereof, determines the legal distribution of his estate.

- Beneficiaries: The individuals or entities who inherit Morrison's assets, as outlined in his will or by law.

- Estate Value: The total value of Morrison's assets, including property, royalties, and personal belongings.

- Legal Disputes: Any legal challenges or conflicts over the distribution of Morrison's estate.

- Family Dynamics: The relationships and interactions among Morrison's family members, and their influence on the inheritance.

- Posthumous Earnings: Revenue generated from Morrison's music, image, and likeness after his death.

- Tax Implications: The tax obligations and liabilities associated with inheriting Morrison's estate.

- Public Interest: The media attention and public fascination surrounding Morrison's legacy and the distribution of his assets.

- Historical Context: The legal and social norms surrounding inheritance and estate planning during Morrison's time.

These key aspects provide a comprehensive framework for examining the complex topic of who inherited Jim Morrison's estate. They encompass legal, financial, interpersonal, and cultural dimensions, offering a multifaceted perspective on this intriguing subject.

Will

The existence or absence of a valid will is a crucial factor in determining the legal distribution of Jim Morrison's estate. A will is a legal document that outlines an individual's wishes regarding the distribution of their property and assets after their death. In the case of Morrison, who died without leaving a will, the legal process of intestacy would have determined the distribution of his estate.

- Testamentary Capacity: To create a valid will, Morrison would have needed to possess testamentary capacity, meaning he was of sound mind and body at the time of its creation.

- Formal Requirements: A will must meet certain formal requirements, such as being in writing, signed by the testator (Morrison), and witnessed by a specified number of individuals.

- Probate: After Morrison's death, his will would have needed to be submitted to a probate court for validation and administration.

- Intestacy: In the absence of a valid will, Morrison's estate would have been distributed according to the laws of intestacy, which vary from state to state.

The presence or absence of a will can significantly impact the distribution of an estate. A valid will allows individuals to control the distribution of their assets and express their final wishes. In the case of Jim Morrison, the lack of a will meant that his estate was distributed according to the laws of intestacy, which may not have aligned with his intentions or preferences.

Beneficiaries

The identification of beneficiaries is a key aspect of estate distribution, ensuring that Jim Morrison's assets are distributed according to his wishes or, in the absence of a will, according to the laws of intestacy. Beneficiaries can include individuals, such as family members or friends, as well as legal entities, such as trusts or charities.

- Family Members: Morrison's immediate family members, including his parents, siblings, and children, would typically be considered primary beneficiaries. They may inherit a portion of his estate, including personal belongings, property, and financial assets.

- Friends: Close friends or individuals who had a significant impact on Morrison's life may also be named as beneficiaries. They could receive specific bequests, such as personal items or royalties from Morrison's music.

- Trusts: A trust is a legal entity that holds and manages assets for the benefit of designated beneficiaries. Morrison could have established a trust to distribute his assets according to his wishes and provide for specific purposes, such as supporting his children's education or funding charitable causes.

- Charities: Morrison may have designated charitable organizations as beneficiaries of his estate. This could reflect his philanthropic interests or a desire to support specific causes close to his heart.

Determining the beneficiaries of Jim Morrison's estate involves examining his will, if one exists, and applying the laws of intestacy if he died without a will. The distribution of assets to beneficiaries can be a complex process, involving legal and financial considerations, as well as the potential for disputes or challenges.

Estate Value

Determining the estate value of Jim Morrison is crucial for understanding the distribution of his assets and the financial implications for his beneficiaries. The estate encompasses various components, each contributing to its overall worth.

- Real Estate: Morrison owned several properties, including his iconic home in Los Angeles, which could constitute a significant portion of his estate value.

- Music Royalties: As the lead singer and songwriter of The Doors, Morrison's estate continues to receive royalties from record sales, streaming, and licensing of his music.

- Personal Belongings: Morrison's personal effects, such as clothing, jewelry, and handwritten lyrics, may hold both sentimental and monetary value.

- Posthumous Earnings: Morrison's estate benefits from ongoing revenue generated through the use of his name, image, and likeness in merchandise, documentaries, and other commercial ventures.

The total estate value ultimately determines the amount of assets available for distribution to beneficiaries. It serves as the basis for calculating taxes, legal fees, and other expenses associated with estate administration. Understanding the estate value provides a comprehensive view of Morrison's financial legacy and its impact on those who inherited his assets.

Legal Disputes

Legal disputes surrounding the distribution of Jim Morrison's estate can significantly impact the determination of who inherits his assets. When legal challenges arise, the distribution process becomes more complex and uncertain, potentially altering the intended beneficiaries and the ultimate allocation of Morrison's wealth.

One of the primary causes of legal disputes in estate distribution is the contestation of a will. If Morrison left a will outlining his wishes for his estate, disputes may arise if certain parties believe the will is invalid or does not accurately reflect his true intentions. These disputes can involve allegations of undue influence, lack of testamentary capacity, or forgery, requiring legal resolution to determine the validity of the will.

Another common source of legal disputes is the absence of a will, resulting in the distribution of assets according to the laws of intestacy. In such cases, disputes may arise among family members or other potential beneficiaries who believe they are entitled to a larger share of the estate. These disputes can involve challenges to the legal heirs, claims of pre-existing agreements or oral promises made by Morrison, and allegations of mismanagement or mishandling of the estate.

Understanding the connection between legal disputes and the determination of who inherits Jim Morrison's estate is crucial for several reasons. First, it highlights the importance of proper estate planning and the execution of a valid will to minimize the risk of disputes and ensure that one's wishes are respected after their death. Second, it demonstrates the complexities involved in estate distribution, particularly when legal challenges arise, and the need for legal expertise to navigate these complexities effectively.

Family Dynamics

The dynamics within a family can significantly influence the distribution of an estate, including the case of Jim Morrison's inheritance. Family relationships, conflicts, and personal histories play a crucial role in shaping the decisions made regarding the allocation of assets.

For instance, if there were strained relationships or unresolved conflicts among Morrison's family members, these could have influenced the distribution of his estate. Family members may have contested the will or challenged the decisions made by the executor, leading to legal disputes and delays in the distribution process.

On the other hand, close and supportive family relationships could have facilitated a smoother distribution of Morrison's estate. Family members may have worked together to honor his wishes and ensure that his legacy was preserved. They may have established trusts or foundations to manage his assets and use them for charitable or educational purposes.

Understanding the family dynamics of Jim Morrison's family provides insights into the complexities of inheritance and estate distribution. It highlights the importance of open communication, conflict resolution, and mutual respect among family members to ensure a fair and equitable distribution of assets.

Posthumous Earnings

Posthumous earnings are a crucial aspect to consider when examining who inherited Jim Morrison's estate. These earnings represent revenue generated from Morrison's music, image, and likeness after his death and constitute a significant portion of his estate's value.

- Music Royalties: Morrison's estate continues to receive royalties from record sales, streaming, and licensing of his music. These royalties provide a steady stream of income and account for a substantial portion of his posthumous earnings.

- Image Licensing: Morrison's image and likeness are valuable assets that can be licensed for use in merchandise, advertising, and other commercial ventures. This generates revenue for his estate and helps preserve his legacy.

- Film and Television: Morrison's music and image have been featured in numerous films and television shows, generating additional revenue for his estate. These appearances help keep his music relevant and introduce his work to new audiences.

- Merchandise Sales: Morrison's estate generates revenue through the sale of merchandise, such as t-shirts, posters, and other items featuring his image or lyrics. This merchandise appeals to fans and collectors, further extending his legacy.

Posthumous earnings play a significant role in the distribution of Jim Morrison's estate, providing a source of income for his beneficiaries and ensuring that his legacy continues to generate revenue. These earnings are a testament to Morrison's enduring popularity and the ongoing value of his music and image.

Tax Implications

Understanding the tax implications associated with inheriting Jim Morrison's estate is crucial for determining who ultimately benefits from his legacy. Estate taxes, income taxes, and capital gains taxes can significantly impact the distribution of assets to beneficiaries.

Estate taxes are levied on the value of an estate at the time of death. The tax rate and exemptions vary depending on the jurisdiction and the size of the estate. In Morrison's case, his estate was valued at approximately $2 million at the time of his death in 1971. Based on the estate tax rates at that time, his estate may have been subject to a significant tax liability.

In addition to estate taxes, beneficiaries may also be liable for income taxes on any income generated by the inherited assets. This includes royalties from music sales, licensing fees, and interest earned on investments. Beneficiaries may also be subject to capital gains taxes if they sell inherited assets for a profit.

The tax implications of inheriting Morrison's estate can have a significant impact on the distribution of assets. Beneficiaries may need to pay substantial taxes before they can fully access their inheritance. It is important for beneficiaries to understand their tax obligations and plan accordingly to avoid any unexpected financial burdens.

Public Interest

In the realm of "Here's Who Inherited Jim Morrison's," public interest plays a captivating role. The media and the general public have been captivated by Morrison's legacy and the distribution of his assets, creating a complex interplay that has shaped the narrative surrounding his estate.

- Celebrity Obsession: Morrison's iconic status as a rock legend has fueled an insatiable public fascination with his life, death, and legacy. The media has capitalized on this fascination, feeding the public's desire for details about his estate and its beneficiaries.

- Morbid Curiosity: Morrison's untimely and enigmatic death has added a layer of morbid curiosity to the public's interest in his estate. Speculation and rumors about the circumstances of his death and the fate of his possessions have kept the story alive in the public consciousness.

- Cultural Significance: Morrison's music and persona have had a profound impact on popular culture, making his legacy a matter of public interest. The distribution of his assets is seen as a way of preserving and honoring his cultural contributions.

- Historical Context: The distribution of Morrison's estate has unfolded against the backdrop of significant cultural and social changes. The 1960s and 1970s were a time of upheaval and experimentation, and Morrison's legacy reflects the spirit of that era.

The public interest in "Here's Who Inherited Jim Morrison's" has shaped the way the story has been told and understood. It has influenced media coverage, driven public curiosity, and added a layer of cultural significance to the distribution of Morrison's estate.

Historical Context

The legal and social norms surrounding inheritance and estate planning during Jim Morrison's time played a crucial role in shaping the distribution of his assets after his death. In the 1960s and 1970s, there was a growing awareness of the importance of estate planning, but it was still not as common as it is today.

As a result, many people died without a will, which meant that their assets were distributed according to the laws of intestacy. These laws varied from state to state, but they generally favored surviving spouses and children. In Morrison's case, he died without a will, and his assets were distributed to his parents and siblings.

The lack of a will also meant that Morrison's estate was subject to estate taxes. These taxes can be significant, and they can eat into the value of an estate. In Morrison's case, his estate was valued at approximately $2 million at the time of his death. However, after taxes and expenses, his beneficiaries received only about $1 million.

The historical context of Morrison's estate is a reminder of the importance of estate planning. By creating a will, individuals can control how their assets are distributed after their death. They can also minimize the impact of estate taxes.

Frequently Asked Questions

This FAQ section aims to address common inquiries surrounding the topic of "Here's Who Inherited Jim Morrison's." It clarifies aspects of inheritance, estate distribution, and related legal matters.

Question 1: Did Jim Morrison leave a will?

No, Jim Morrison died without leaving a will, resulting in the distribution of his assets according to the laws of intestacy.

Question 2: Who inherited Jim Morrison's estate?

In the absence of a will, Morrison's estate was distributed to his parents and siblings, as per the intestacy laws of California, where he resided at the time of his death.

Question 3: What was the estimated value of Jim Morrison's estate?

At the time of his death in 1971, Morrison's estate was valued at approximately $2 million, primarily comprising royalties, personal belongings, and real estate.

Question 4: Were there any legal disputes over Morrison's estate?

Yes, there were legal disputes among Morrison's family members regarding the management and distribution of his estate, which were eventually resolved through negotiation and legal proceedings.

Question 5: How has Morrison's estate continued to generate income?

Posthumous earnings from music royalties, image licensing, and merchandise sales have contributed to the ongoing revenue generated by Morrison's estate, ensuring its preservation and benefiting his heirs.

Question 6: What are the key takeaways from understanding Morrison's inheritance?

The case of Jim Morrison's estate highlights the significance of estate planning and the legal complexities involved in inheritance. It also emphasizes the enduring impact of a celebrity's legacy and the public's fascination with the distribution of their assets.

These FAQs provide insights into the intricacies of Jim Morrison's inheritance, offering a deeper understanding of the legal and financial aspects surrounding his estate. Delving further into the topic, the next section will explore the enduring legacy of Jim Morrison and the preservation of his artistic contributions.

Tips for Understanding Jim Morrison's Inheritance

This section provides practical tips for comprehending the complexities surrounding Jim Morrison's inheritance, estate distribution, and legal implications.

Tip 1: Research Intestacy Laws: Familiarize yourself with the laws governing the distribution of assets without a will, as in Morrison's case.

Tip 2: Understand Estate Valuation: Determine the various components that contribute to the value of an estate, including real estate, royalties, and personal belongings.

Tip 3: Explore Legal Disputes: Examine the potential causes and complexities of legal disputes that may arise during estate distribution.

Tip 4: Consider Family Dynamics: Analyze the influence of family relationships on inheritance decisions and the distribution of assets.

Tip 5: Examine Posthumous Earnings: Understand the revenue streams generated from an estate after the individual's death, such as royalties and licensing fees.

Tip 6: Be Aware of Tax Implications: Recognize the tax obligations and liabilities associated with inheriting an estate, including estate taxes and income taxes.

Tip 7: Appreciate Public Interest: Acknowledge the media attention and public fascination surrounding celebrity estates and the distribution of assets.

Tip 8: Study Historical Context: Examine the legal and social norms regarding inheritance and estate planning during the time of Jim Morrison's death.

By following these tips, you can gain a comprehensive understanding of the intricacies involved in Jim Morrison's inheritance, the legal complexities of estate distribution, and the enduring impact of a celebrity's legacy.

These tips serve as a foundation for the concluding section of this article, which will delve into the preservation of Jim Morrison's artistic contributions and the enduring fascination with his legacy.

Conclusion

The intricate details of Jim Morrison's inheritance offer a valuable lens into the complexities of estate distribution, legal battles, and the preservation of artistic legacies. The absence of a will and the subsequent legal disputes highlight the importance of estate planning and the potential pitfalls when it is neglected.

Morrison's enduring legacy as a cultural icon underscores the insatiable public fascination with celebrity inheritances. The distribution of his assets serves as a reminder of the enduring power of music and art, transcending the physical realm and continuing to generate revenue and cultural impact.

The story of "Here's Who Inherited Jim Morrison's" underscores the enduring fascination with the lives and legacies of iconic figures. It also serves as a reminder of the importance of understanding the legal and financial implications of inheritance, both for celebrities and ordinary individuals alike.

Caryn zucker net worth wiki age wife

Who is spencer herron his wikipedia wife

Is phil kim married to grace park

ncG1vNJzZmiqqpl7tLLOa2WdoZeewaK4zpycmqajpa6ksdJnmqilX52ys7GMrGSwoJ9itq%2B0xKugrZ2UYrequYympquqmai8r3nSZ5%2BtpZw%3D